Wellbeing programmes are increasingly popular amongst companies wanting to appear futuristic when it comes to employee perks. Financial wellbeing platforms are starting to be viewed as the most impactful and rewarding wellbeing solutions, with HR leaders beginning to encourage a larger focus on these. This article takes a closer look at pension education and why it is the future of workplace wellbeing.

Mental Health and Financial Wellbeing

Research shows that the increase in mental health issues across the nation is often linked to financial worries. Almost 4 in 10 people with a mental health problem reportedly said that their financial situation had worsened their mental health problems.

Financial and pension education platforms are an inclusive wellbeing solution and could help hugely to lessen employees mental health concerns. Many assume that money and pension worries only affect those on a lower income, but this is not true. These worries are found to be relevant amongst most employees regardless of earnings.

People on low incomes are not the only ones concerned about their pension wellbeing. The focus should be shifted onto providing employees with access to pension education platforms. No matter the income bracket, everyone could benefit from improved pension wellbeing.

Employers’ Wellbeing Duty

The findings within this article support the notion that employers are largely responsible for employees financial and pension wellbeing. The idea that employees earning a higher salary would not benefit much from help when it comes to pension wellbeing and education is not accurate. Employees earning low and high incomes should all be included in wellbeing initiatives and would all benefit from increased guidance when it comes to managing their pensions.

Due to the lack of pension education offered in schools as suggested in our previous article, employers should work on supporting the education of employees in this area by offering helpful tools, specifically access to pension wellbeing platforms.

The Future of Wellbeing

According to Phil Schuman, Director at MoneySmarts program at Indiana University, “financial literacy is important because if you learn about it, it’s going to teach you how to be efficient with your finances in such a way that you can accomplish more goals, and the goals that you do have, faster.” Pension wellbeing platforms can be personalised by employees to reflect their own circumstances – this provides a personal experience and ensures that every employee can tailor their platform to achieve their specific pension goals.

There is strong evidence that pension education really does make a difference to employee wellbeing. Research shows that 12 million individuals are under-saving for their retirement. This highlights the need for a better understanding of how individuals make decisions about their pension following automatic workplace enrolment. Research shows that pension education is beneficial to employees in the long term. Pension education is a worthwhile investment for employers and increases the success of their business significantly.

Introducing pension wellbeing platforms and prioritising pension education is a guaranteed way to ensure that your business thrives by taking care of your employees’ wellbeing.

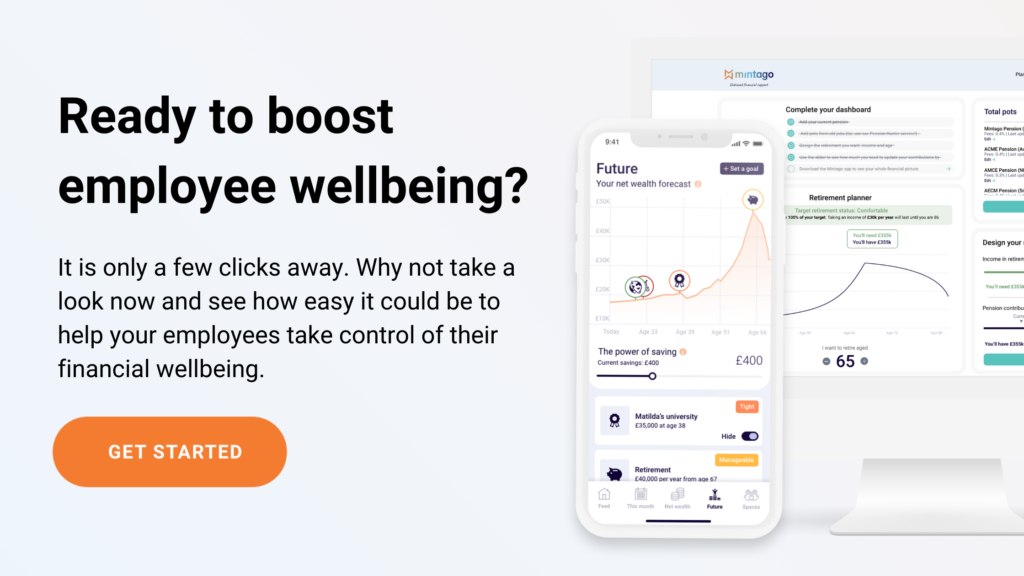

To learn more about pension education and why financial and pension wellbeing platforms such as Mintago are beneficial to employees, visit our website and contact Mintago today.